Unlocking the Secrets of the North Reading, MA

**Unlocking the Secrets of the North Reading, MA 01864 Real Estate Market: A Deep Dive into the Numbers**

If you’re considering entering the real estate market in North Reading, Massachusetts, you’re in for a dynamic journey. The picturesque town, known for its charming neighborhoods and excellent school system, is currently experiencing intriguing trends that savvy buyers and sellers should take note of.

**Current Market Snapshot: Single Family Listings**

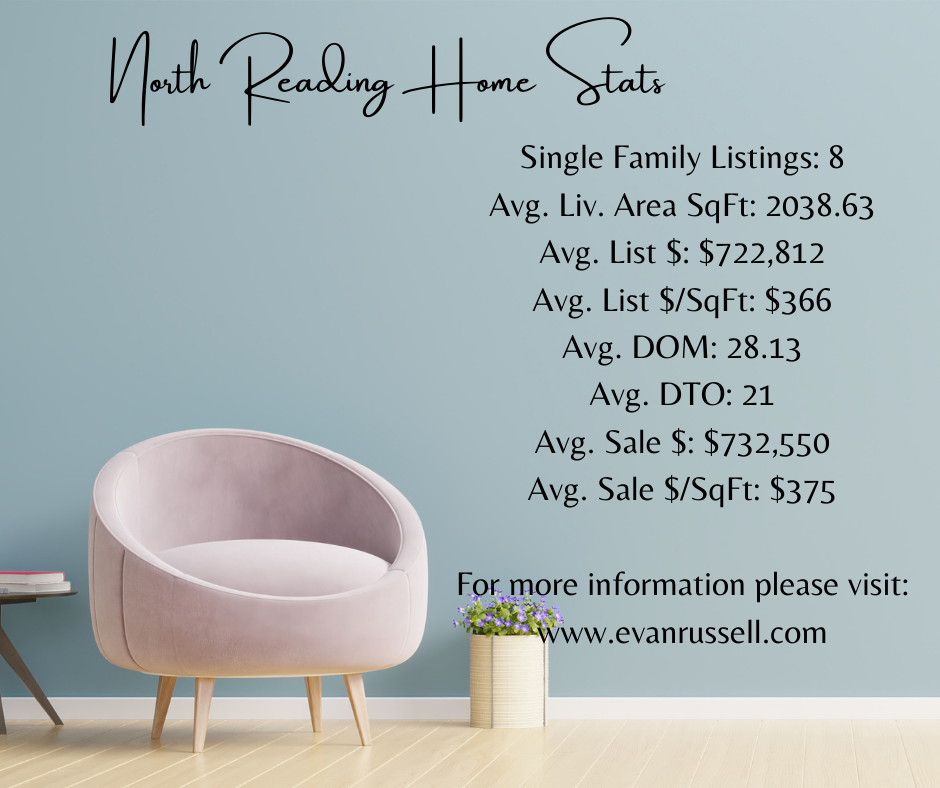

As of November ’23, North Reading boasts a total of 8 single-family listings, offering a snapshot of the town’s housing inventory. These homes vary in size, style, and amenities, contributing to the diverse options available to potential buyers.

**Size Matters: Average Living Area SqFt**

Buyers looking for spacious homes will be pleased to note that the average living area of listed homes in North Reading is approximately 2038.63 square feet. This suggests a preference for roomy residences, catering to the needs of families and individuals alike.

**Setting the Price: Average List Price**

For those curious about the financial aspect, the average list price in North Reading stands at $722,812. This figure is reflective of the town’s desirability and the quality of homes available. It’s essential to note that this average encompasses the entire range of homes on the market, from cozy bungalows to luxurious estates.

**Breaking it Down: Average List Price per Square Foot**

Delving further into the pricing dynamics, the average list price per square foot is $366. This metric provides insights into how the market values space within a home. It’s a critical factor for both buyers and sellers, helping them understand the relative value of different-sized properties.

**Timing is Key: Average Days on Market (DOM) and Average Days to Offer (DTO)**

The North Reading real estate market moves at a steady pace. On average, homes spend approximately 28.13 days on the market before attracting an offer. The average days to offer (DTO) is even more impressive, standing at 21 days. These figures underscore the town’s appeal and the efficiency of its real estate transactions.

**What Homes Are Selling For: Average Sale Price**

For those with an eye on the bottom line, the average sale price in North Reading is $732,550. This provides valuable insights for sellers looking to set a competitive yet realistic asking price and for buyers assessing their budget and negotiating power.

**Dollars and Sense: Average Sale Price per Square Foot**

Analyzing the data from another perspective, the average sale price per square foot is $375. This metric further refines the understanding of property values, assisting both buyers and sellers in making informed decisions.

**Conclusion: Navigating the North Reading Real Estate Landscape**

As North Reading, MA, continues to draw interest from homebuyers, understanding the market trends becomes paramount. With an average list price of $722,812 and an efficient sales cycle, the town offers a promising real estate landscape. Whether you’re a buyer seeking the perfect home or a seller looking to make a smart move, these statistics provide valuable insights into the dynamics of the North Reading real estate market. Stay tuned for updates as this vibrant market evolves, and opportunities unfold.

September ’23 Market Trends for North Reading

Title: “Exploring the Real Estate Landscape in North Reading’s 01864 Zip Code”*

Are you considering buying or selling a single-family home in North Reading’s 01864 zip code? If so, you’re in the right place. This picturesque town, located in Middlesex County, Massachusetts, has a lot to offer to both homebuyers and sellers. In this blog post, we’ll dive into the current real estate market stats for North Reading’s 01864 zip code to give you a better understanding of what’s happening in the area.

**1. Abundant Choices for Single Family Homes**

As of the latest data available, there are 10 single-family homes listed in the 01864 zip code. This means that potential buyers have a decent selection to choose from, ensuring there’s something for everyone’s tastes and preferences.

**2. Spacious Living Areas**

The average living area square footage for these single-family homes is an impressive 2,581.9 square feet. This spaciousness provides ample room for families to grow, entertain, and enjoy their living spaces comfortably.

**3. Competitive Listing Prices**

The average list price for homes in North Reading’s 01864 zip code stands at $865,170. This figure provides a reasonable starting point for negotiations and gives buyers and sellers alike a sense of the local market’s pricing trends.

**4. Price Per Square Foot**

For those who like to dig deeper into the numbers, the average list price per square foot comes in at $367. This metric can be particularly useful for comparing the relative value of different properties and understanding how much space you’re getting for your money.

**5. Quick Turnaround**

On average, homes in this area spend approximately 16.8 days on the market (DOM) before finding their new owners. This relatively short timeframe suggests that the market is active and that desirable properties are moving quickly.

**6. Swift Sales**

Once a property goes under contract, it typically takes just 9 days on average for it to close. This “days to offer” (DTO) metric highlights the efficiency of the local real estate transactions, ensuring that buyers and sellers can wrap up their deals in a timely manner.

**7. Strong Sale Prices**

The average sale price for homes in North Reading’s 01864 zip code comes in at a robust $879,300. This figure reflects the actual market value of properties in the area and can help sellers set realistic expectations for their homes’ final sale prices.

**8. Price Per Square Foot at Sale**

For those interested in the price per square foot at the time of sale, the average is $372. This number illustrates how much buyers are willing to pay for each square foot of living space, providing valuable insights into the market’s demand.

In conclusion, North Reading’s 01864 zip code offers a dynamic real estate market with a variety of single-family homes, spacious living areas, and competitive pricing. With homes selling relatively quickly and at strong prices, it’s an exciting time for both buyers and sellers in this charming Massachusetts town. If you’re considering a move to North Reading or planning to sell your property here, these market stats should give you a solid starting point for your real estate journey. Remember to work with a knowledgeable local real estate agent to navigate this vibrant market successfully.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link